Introduction

With the rise of the global healthy - eating trend, mushrooms, as an ingredient with low calories, high protein, and rich in vitamins and minerals, have gradually become an important part of consumers' dining tables. As one of the important economies in Asia, the mushroom market in South Korea has also shown a rapid - growth trend in recent years. This guide will comprehensively analyze the current situation, future trends, challenges faced, and the behavior habits of consumer groups in the South Korean mushroom market, providing valuable insights for industry practitioners and investors.

2.1 Market Size

The mushroom market in South Korea has been growing rapidly in recent years. It is expected that the market size will reach 1.5 trillion won (about $1.2 billion) by 2025, with a compound annual growth rate (CAGR) of 8.5% from 2021 to 2025. This growth is mainly driven by the increasing demand for healthy foods among consumers, especially their preference for nutritious mushroom products.

2.2 OutputIn 2021, the total mushroom output in South Korea was approximately 120,000 tons. Oyster mushrooms and shiitake mushrooms were the main varieties, accounting for 45% and 30% of the total output respectively. The output of other varieties such as pleurotus eryngii and enoki mushrooms is also gradually increasing. The mushroom - cultivation area in South Korea is about 500 hectares, mainly concentrated in regions such as Gyeongsangbuk - do and Jeollanam - do. These areas have a suitable climate and fertile soil, which are very suitable for mushroom cultivation.

Analysis of the Consumer Market

3.1 Household Consumption

With the enhancement of the health awareness of South Korean consumers, mushrooms have gradually become a common ingredient on family dining tables. Market research data shows that the purchase volume of mushrooms by South Korean households is increasing year by year, with an average annual growth rate of about 5% - 7%. Consumers not only buy common oyster mushrooms and shiitake mushrooms but also show a strong interest in specialty mushrooms such as pleurotus eryngii and enoki mushrooms. Supermarkets and farmers' markets are the main channels for household consumers to buy mushrooms.

3.2 The Catering IndustryThe catering industry in South Korea is developed. As a multi - purpose ingredient, mushrooms are widely used in various dishes, such as mushroom soup, mushroom hot pot, and mushroom - fried rice. With the improvement of consumers' requirements for the quality of ingredients, the demand of catering enterprises for fresh and high - quality mushrooms is constantly increasing. In recent years, the number of new restaurants in South Korea has been increasing year by year, further driving the growth of the mushroom market. The demand for mushrooms in the catering industry is growing at a rate of 6% - 8% per year.

3.3 The Food Processing IndustryThe food processing industry is an important driving factor for the demand in the South Korean mushroom market. Mushrooms are processed into various products such as canned mushrooms, mushroom sauces, and dehydrated mushrooms, which not only meet the domestic demand but are also exported to other countries. With the progress of food processing technologies and the increasing preference of consumers for convenient foods, the purchase volume of mushrooms by food processing enterprises is constantly increasing. It is expected that the demand for mushrooms in the food processing industry will grow at a rate of 5% - 7% per year.

Market Trends4.1 Challenges in Raw Material Supply

The mushroom industry in South Korea faces challenges in raw material supply. The supply of raw materials such as straw and horse manure required for mushroom cultivation is unstable, especially in areas with limited agricultural resources. In addition, with the strengthening of environmental protection regulations, the use of traditional peat substrates is restricted, and mushroom growers are looking for more environmentally friendly alternative materials.

4.2 The Demand for SustainabilityWith the enhancement of environmental awareness, the South Korean mushroom market is paying more and more attention to sustainability. Growers are exploring more environmentally friendly cultivation technologies and materials to reduce the impact on the environment. The demand of consumers for sustainably produced mushroom products is also increasing, prompting enterprises to adopt more green production methods, such as reducing the use of chemical pesticides and improving resource efficiency.

4.3 Technological InnovationTo solve the problem of raw material supply and meet market demand, technological innovation is the key. Mushroom growers in South Korea are introducing intelligent cultivation management systems. By precisely controlling environmental factors such as temperature, humidity, and lighting, the yield and quality of mushrooms can be improved. At the same time, researchers are developing new cultivation substrates and strains to adapt to market changes.

4.4 Import Dependence and Market CompetitionSouth Korea is one of the major mushroom - consuming markets in Asia. The domestic output cannot fully meet the demand, and it is dependent on imports. China and Vietnam are the main sources of South Korea's mushroom imports. The competition among growers and distributors of different sizes in the domestic market is very fierce. Large - scale enterprises have advantages in cost and quality with advanced technologies and economies of scale, while small - scale enterprises compete through unique products and personalized services.

The Working Population in the South Korean Mushroom Industry5.1 Population Size

As of 2023, the number of people employed in the South Korean mushroom industry is about 10,000 - 15,000, including full - time and seasonal workers. Seasonal workers mainly come from Southeast Asian countries such as Vietnam and the Philippines.

5.2 Regional DistributionMushroom production in South Korea is mainly concentrated in Gyeongsangbuk - do and Jeollanam - do. The mushroom output in these two regions accounts for more than 60% of the total national output. Other regions such as Chungcheongnam - do and Gangwon - do also have a certain output.

5.3 Farm ScaleMushroom farms in South Korea are mainly small - and medium - sized. About 70% of the farms are family - operated, usually employing fewer than 10 people. Large - scale farms account for about 20%, mainly concentrated in Gyeongsangbuk - do and Jeollanam - do.

5.4 Labor StructureLocal workers account for about 60% and are mainly engaged in management and technical work. Foreign workers account for about 40% and are mainly engaged in picking and packaging work.

Development Trends of the South Korean Mushroom Industry6.1 Output Growth and Variety Diversification

Mushrooms dominate the market. In 2021, the mushroom output in South Korea reached 120,000 tons, a year - on - year increase of 5%. The output of specialty mushrooms such as pleurotus eryngii and enoki mushrooms is growing rapidly, reflecting consumers' demand for diverse mushroom varieties.

6.2 Technological Innovation and Intelligent ProductionMushroom growers in South Korea are improving production efficiency and reducing labor costs through intelligent cultivation management systems. The application of biotechnology is also advancing. Researchers are developing mushroom varieties with stronger disease resistance and higher yields.

6.3 Market Demand and Consumption TrendsThe healthy - eating trend has driven the demand for mushrooms. Mushrooms are known for their low calories, high protein, and rich vitamins and minerals and have become a symbol of a healthy diet. After the pandemic, the increase in home cooking has further driven the demand for fresh mushrooms.

6.4 International Competition and Export ChallengesLow - priced mushroom products from countries such as China have put pressure on the South Korean domestic market, prompting South Korean enterprises to enhance their brand value. South Korea maintains its competitiveness through technological innovation and quality advantages and is also actively expanding into international markets.

6.5 Sustainability and Environmental PressureThe traditional peat - substrate cultivation method faces environmental criticism. South Korea is exploring alternative materials such as straw. In addition, South Korea's environmental protection regulations are also constantly strengthening, and the mushroom industry needs to find more environmentally friendly packaging and production methods.

The Main Consumer Groups in the South Korean Mushroom Market7.1 Divided by Age

Young People: Young people in South Korea are paying more and more attention to a healthy and diversified diet. The rich flavor and versatility of mushrooms attract them. Mushrooms often appear in party dishes or snacks, such as mushroom pizza or skewers.

Middle - aged and Elderly People: Middle - aged and elderly people pay more attention to health and health care. The high nutritional value of mushrooms meets their needs. Mushrooms are rich in vitamins and minerals, which help enhance immunity and prevent diseases, and have become part of their daily diet.

7.2 Divided by Consumption Scenarios and OccupationsHousewives/Househusbands: As the main shoppers and cooks in the family, housewives/househusbands include mushrooms in their daily meals to meet the needs of family members of different ages.

Office Workers: Due to their busy work, office workers have a high demand for convenient and nutritious foods. Mushrooms can be used as ingredients in fast - food, such as mushroom burgers or pasta.

Fitness and Health Enthusiasts: Fitness and health enthusiasts have high requirements for protein and dietary fiber. Mushrooms are rich in these nutrients but have low calories, making them very suitable for healthy meals.

7.3 Divided by Dietary PreferencesVegetarians and Vegans: Mushrooms are an important protein source for vegetarians and vegans, providing rich nutrition as a meat substitute.

Food Enthusiasts: There are many food enthusiasts in South Korea who pursue high - quality and unique flavors. The variety and unique flavor of mushrooms provide them with a rich cooking experience.

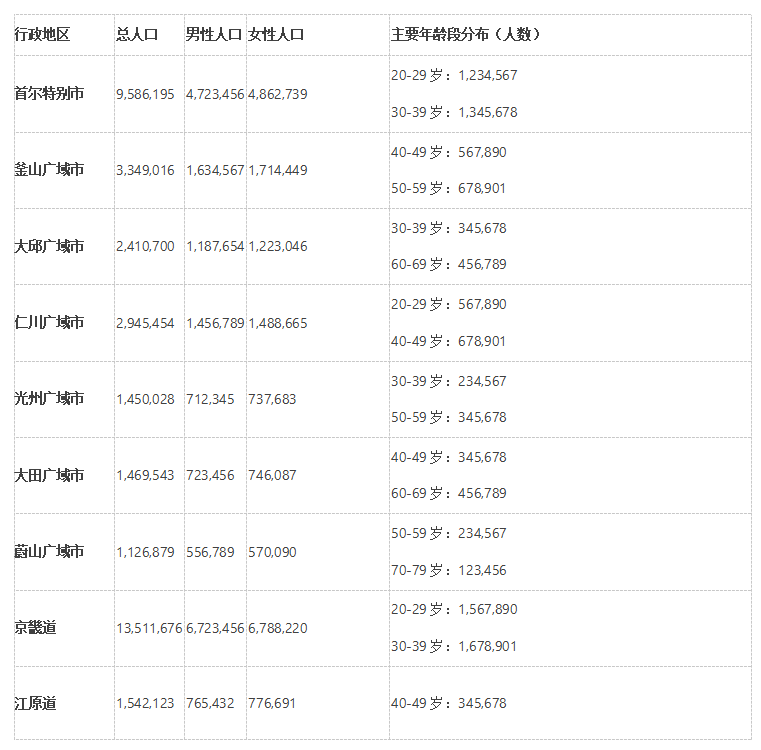

The following is a summary of data on the age structure of the South Korean population, classified according to the administrative regions of South Korea, and providing the population numbers of men and women in different age groups. The data is based on the latest population statistics (as of 2022) of Statistics Korea.

Appendix 1: Summary of Data on the Age Structure of the South Korean Population (2022)Total National Population

Total population: 51,638,809

Men: 25,739,056

Women: 25,899,753

Appendix 2: Population Numbers by Age Group

Appendix 3: Population Data Classified by Administrative Region

South Korea has a total of 17 first - level administrative regions, including 1 special city (Seoul), 6 metropolitan cities, 8 provinces, and 1 special self - governing province (Jeju Province). The following is a summary of the population data of each region:

The following is the population data classified by the administrative regions of South Korea, presented in tabular form, including the total population, male population, female population, and the distribution of the main age groups. The data is based on the latest population statistics (as of 2022) of Statistics Korea.

创新博览会LOGO-white.png)

Copyright © China Chamber of Commerce of Food, Native Produce and Animal Products Edible Fungi and Products Branch

京公网安备11010102004652号 京ICP备05021290号-29 | Technical Support: Starify Privacy Policy Sitemap Contact Us

创新博览会LOGO.png)

.webp)