The Japanese mushroom market holds an important position in the global edible mushroom field. With its unique production technologies, high - quality products, and strong consumer demand, it has become an important participant in the mushroom industry in Asia and even globally. In recent years, as Japanese consumers' health awareness has increased and their demand for functional foods has risen, mushrooms, as a low - calorie and highly nutritious ingredient, have gradually become an important part of family dining tables, the catering industry, and the food processing industry. This guide will comprehensively analyze the current situation of the Japanese mushroom market, deeply explore future trends, and analyze the challenges faced in detail, providing valuable insights for industry practitioners and investors.

The Japanese mushroom market has been growing steadily in recent years. In 2023, the market size reached 120 billion yen (approximately 1.1 billion), and it is expected to grow to 180 billion yen (approximately 1.65 billion) by 2030, with a compound annual growth rate (CAGR) of 6.5%. The growth of the mushroom market is mainly driven by the increasing demand for healthy foods from consumers and the wide application of mushrooms in functional foods and the catering industry.

1.2 Output and VarietiesIn 2023, the total mushroom output in Japan was 150,000 tons, and the main varieties include:

Shiitake Mushrooms (40% share): Japanese shiitake mushrooms are famous for their unique flavor and high nutritional value and are mainly used in home cooking and the catering industry.

Enoki Mushrooms (30% share): Enoki mushrooms are widely used in hot pots, salads, and ready - to - eat foods due to their crispy texture and rich dietary fiber.

Oyster Mushrooms (20% share): Oyster mushrooms, with their high - protein and low - fat characteristics, have become representatives of healthy diets.

Other Varieties (10% share): This includes specialty mushrooms such as pleurotus eryngii and maitake, which are gradually gaining popularity among consumers.

1.3 Main Production AreasMushroom production in Japan is mainly concentrated in the following regions:

Hokkaido: Accounts for 25% of the national output, mainly producing shiitake mushrooms and enoki mushrooms.

Kyushu Region: Accounts for 20% of the national output, mainly producing oyster mushrooms and pleurotus eryngii.

Kanto Region: Accounts for 15% of the national output, mainly producing factory - grown enoki mushrooms.

Chapter 2: Consumption Situation2.1 Household ConsumptionWith the popularization of the concept of healthy eating, mushrooms, with their high - protein, low - fat, and vitamin - and - mineral - rich characteristics, have become regulars on Japanese family dining tables. According to market research data, the purchase volume of mushrooms by Japanese households has been steadily increasing in the past few years, with an annual growth rate of 3% - 5%. Consumers are no longer just satisfied with common shiitake mushrooms, and their willingness to purchase specialty mushrooms such as enoki mushrooms, oyster mushrooms, and pleurotus eryngii is also increasing.

2.2 The Catering IndustryThe catering industry in Japan is booming, with a large number of restaurants and cafes. As a versatile ingredient, mushrooms are widely used in various dishes, such as mushroom soup, mushroom tempura, and mushroom sushi. As consumers' requirements for the quality and taste of dishes increase, catering enterprises pay more attention to the selection of ingredients, and fresh and high - quality mushrooms have become their first choice. In recent years, the number of newly opened restaurants in Japan has been increasing year by year, and the demand for mushrooms has also risen accordingly, driving the further growth of the mushroom market demand. According to industry estimates, the annual growth rate of the catering industry's demand for mushrooms is about 6% - 8%.

2.3 The Food Processing IndustryThe food processing industry is an important demand side of the Japanese mushroom market. Mushrooms are processed into various products, such as canned mushrooms, mushroom sauces, and dehydrated mushrooms. These processed products not only meet the domestic market demand but are also exported to other countries. With the continuous progress of food processing technologies and consumers' preference for convenient foods, the purchase volume of mushrooms by food processing enterprises has been continuously increasing. For example, some well - known food processing enterprises increase the production lines of canned mushrooms every year to meet the market demand for canned mushrooms of different specifications and flavors, driving the demand of the Japanese mushroom market to grow at a rate of 5% - 7% per year.

Chapter 3: Market Trends3.1 Challenges in Raw Material SupplyCurrently, the Japanese mushroom industry is facing difficulties in raw material supply. On the one hand, the poor grain harvest in many regions has led to a shortage of straw, which is one of the important raw materials for mushroom cultivation. On the other hand, the supply of wood chips has also become more difficult because these materials are used for other non - agricultural purposes. In addition, by 2030, peat in commercial horticulture will be replaced, which has a huge impact on mushroom cultivation. As peat is applied as a covering layer on the substrate and is crucial for the formation of mushroom fruiting bodies, although alternatives have been sought for many years, no viable substitute in terms of quantity and quality has been found yet.

3.2 The Need for Sustainable DevelopmentWith the enhancement of environmental awareness, the Japanese mushroom market is paying more and more attention to sustainable development. From the cultivation aspect, growers will explore more environmentally friendly cultivation technologies and materials to reduce the impact on the environment. In terms of products, consumers' demand for sustainably produced mushroom products is increasing, which prompts enterprises to adopt green and environmentally friendly methods in the production process, such as reducing the use of chemical pesticides and improving resource utilization.

3.3 Driven by Technological InnovationTo address the issue of raw material supply and meet market demand, technological innovation has become the key. The factory - scale production technology is constantly developing. By precisely controlling environmental factors such as temperature, humidity, and lighting, the yield and quality of mushrooms can be improved. At the same time, researchers are also actively developing new cultivation substrates and strains to adapt to market changes, such as looking for new substrates that can replace peat and cultivating mushroom varieties with stronger stress resistance and higher yields.

3.4 Import Dependence and Market CompetitionJapan is an important mushroom consumption market in Asia. Its own production cannot fully meet the demand, and it has a certain dependence on imported mushrooms. Countries such as China and South Korea are the main sources of mushroom imports for Japan. A large number of shiitake mushrooms produced in China are exported to Japan, and the total export volume accounts for 80% of the total production volume. South Korea has a developed edible mushroom industry and is also an important mushroom supplier to Japan. In the domestic market, there is fierce competition among mushroom - growing enterprises and distributors of different sizes. Large - scale enterprises have advantages in cost and quality with advanced technologies and large - scale production, while small - scale enterprises strive for market share through characteristic products and personalized services.

Chapter 4: The Working Population in the Japanese Mushroom IndustryAs of December 2023, the working population in the Japanese mushroom industry is as follows:

4.1 Population QuantityTotal Working Population: The number of people employed in the Japanese mushroom industry is about 10,000 - 12,000, including full - time and seasonal workers.

Seasonal Workers: About 30% - 40% of them are seasonal workers, mainly from Southeast Asian countries such as Vietnam and the Philippines.

4.2 Regional DistributionMain Production Areas:

Hokkaido: This region is the core area of mushroom production in Japan, with about 30% of the mushroom farms.

Kyushu Region: Accounts for 20% of the national mushroom output.

Kanto Region: Accounts for 15% of the national output.

4.3 Farm ScaleSmall - Scale Farms: About 50% of the mushroom farms are small - scale family - operated, usually with fewer than 10 employees.

Large - Scale Farms: About 30% of the farms are large - scale, with more than 50 employees, mainly concentrated in Hokkaido and the Kyushu region.

4.4 Labor StructureLocal Workers: About 70% are local Japanese workers, mainly engaged in management and technical positions.

Foreign Workers: About 30% are foreign workers, mainly engaged in picking and packaging work.

4.5 Industry TrendsAutomation: In recent years, the Japanese mushroom industry has gradually introduced automation technologies, reducing the dependence on physical labor.

Sustainable Agriculture: The proportion of organic mushroom cultivation is increasing year by year, attracting more young practitioners.

Chapter 5: Development Trends of the Japanese Mushroom Industry5.1 Output Growth and Variety DiversificationShiitake Mushrooms Dominating the Market: In 2023, the output of shiitake mushrooms in Japan reached 60,000 tons, a year - on - year increase of 5%, accounting for 40% of the total national mushroom output.

The Rise of Specialty Mushrooms: The output of rare varieties such as pleurotus eryngii and maitake is rising rapidly. For example, the output of pleurotus eryngii reached 15,000 tons in 2023, a year - on - year surge of 20%.

The Increase in the Proportion of Organic Mushrooms: The proportion of organic mushroom output increased from 10% in 2020 to 12% in 2023, reflecting consumers' preference for green foods.

5.2 Technological Innovation and Intelligent ProductionFactory - scale and Automation: Japanese enterprises improve production efficiency and reduce labor costs through intelligent cultivation management systems (such as temperature control and LED lighting).

Application of Biotechnology: Improve strains to enhance disease resistance and yield, such as developing mushroom varieties with better storage resistance and high nutrition.

5.3 Market Demand and Consumption TrendsDriven by a Healthy Diet: Mushrooms, with their low - calorie, high - protein, and vitamin - and - mineral - rich characteristics, have become representatives of a healthy diet, and the market demand is growing steadily.

Changes in Consumption Patterns after the Pandemic: During the pandemic, the frequency of home cooking increased, driving the demand for fresh mushrooms. Especially, the market share of enoki mushrooms increased from 40% to 45%.

5.4 International Competition and Export ChallengesPrice Competition in Asia: Low - priced mushroom products from Asian countries such as China pose pressure on the Japanese domestic market, prompting Japanese enterprises to enhance brand added value.

Supply Chain Optimization: Japan maintains its competitiveness through technological innovation and quality advantages, especially in the high - end mushroom market.

Chapter 6: The Main Consumer Groups in the Japanese Mushroom Market6.1 Divided by AgeYoung People: Young people in Japan are paying more and more attention to a healthy and diversified diet. They are enthusiastic about trying new ingredients and cooking methods, and the rich taste and diverse cooking possibilities of mushrooms attract them.

Middle - aged and Elderly People: Middle - aged and elderly people are more concerned about health preservation and a healthy diet, and the high nutritional value of mushrooms meets their needs.

6.2 Divided by Consumption Scenarios and OccupationsHousewives/Househusbands: As the main purchasers and cooks of family diets, housewives/househusbands will consider the health and nutrition of their families and include mushrooms in their daily recipes.

Office Workers: Due to their busy work, office workers have a high demand for convenient and nutritious foods. Mushrooms can be used as ingredients for fast - food products or raw materials for convenience foods.

6.3 Divided by Dietary PreferencesVegetarians and Vegans: Mushrooms are one of the important protein sources for vegetarians and vegans and can replace meat to provide them with rich nutrition.

Food Enthusiasts: There are many food enthusiasts in Japan, and they have high pursuits for the quality and unique flavor of ingredients.

Chapter 7: The Main Challenges and Future Prospects of the Japanese Mushroom Market7.1 Main ChallengesRaw Material Supply Problems: The shortage of raw materials such as straw and wood chips poses challenges to mushroom cultivation.

Labor Shortage: With the intensification of the aging population, the labor shortage problem in the mushroom industry is becoming increasingly serious.

Increased Market Competition: Low - priced mushroom products from countries such as China and South Korea pose pressure on the Japanese market.

7.2 Future ProspectsTechnological Innovation: Improve the yield and quality of mushrooms through intelligent cultivation and the application of biotechnology.

Sustainable Development: Promote organic mushroom cultivation and environmentally friendly packaging to meet consumers' demand for green foods.

Market Expansion: Enhance the competitiveness of Japanese mushrooms in the international market through brand building and market promotion.

ConclusionDriven by technological innovation, sustainable development, and consumer demand, the Japanese mushroom market shows strong growth potential. Although facing challenges such as raw material supply, labor shortage, and international competition, through industry cooperation and policy support, the Japanese mushroom industry is expected to maintain its leading position in the next few years and provide valuable experience for the development of the global mushroom market.

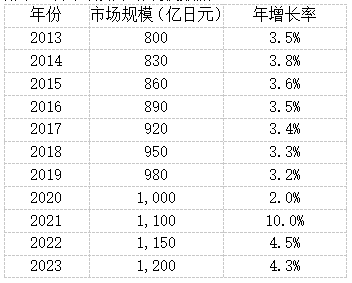

Appendix: Data on the Market Size of the Japanese Mushroom Market (2013 - 2023)

创新博览会LOGO-white.png)

Copyright © China Chamber of Commerce of Food, Native Produce and Animal Products Edible Fungi and Products Branch

京公网安备11010102004652号 京ICP备05021290号-29 | Technical Support: Starify Privacy Policy Sitemap Contact Us

创新博览会LOGO.png)

.webp)