In the current era of deep integration of digitalization and consumption upgrading, the e - commerce and food delivery markets in South Korea are booming. Coupang, Baemin, and Yogiyo, as the three major giants in South Korea's e - commerce and food delivery sectors, play a crucial role in shaping the market landscape and meeting consumer demands. Their development trajectories, market performances, operation strategies, and competitive advantages not only reflect the current situation of South Korea's e - commerce and food delivery industries but also provide valuable references for industry participants. For food ingredient suppliers and traders, a deep understanding of these three platforms is an important prerequisite for seizing market opportunities and expanding their businesses in South Korea.

Establishment Time: Coupang was founded in 2010. Initially, it was a group - buying website and later transformed into a comprehensive e - commerce platform. It went public on the New York Stock Exchange in 2021.

Market Share: Coupang is one of the largest e - commerce platforms in South Korea, accounting for more than 30% of the South Korean e - commerce market share. It is also an important player in the food delivery market.

Coverage: Coupang's services cover the entire territory of South Korea, especially in big cities like Seoul and Busan, where it has a strong user base.

1.2 Operation ModelPlatform Model: Coupang adopts a comprehensive e - commerce platform model, offering a full range of products from daily necessities and electronic products to fresh food. Its food delivery service, Coupang Eats, provides fast delivery through its own logistics network.

Delivery Service: Coupang is famous for its "Rocket Delivery", promising to complete deliveries within 24 hours. Some products can even be delivered within a few hours after the order is placed.

Co - operating Merchants: Coupang collaborates with various food and beverage enterprises, including chain restaurants, small and medium - sized restaurants, and street snack shops.

1.3 Competitive AdvantagesPowerful Logistics Network: Coupang has its own self - built logistics system, with fast delivery speed and excellent user experience.

Diversified Services: In addition to e - commerce and food delivery, Coupang also provides fresh food delivery, membership services (Coupang Wow Membership), etc., enhancing user stickiness.

Technological Innovation: Coupang optimizes the recommendation system through big data and artificial intelligence technologies to improve the user shopping experience.

1.4 Significance for Suppliers and TradersExpanding Sales Channels: By collaborating with Coupang, suppliers can reach a wide range of consumer groups, especially young people and family users.

Data Analysis Support: Coupang provides detailed sales data and consumer behavior analysis, helping suppliers optimize their products and services.

2. Baemin (배달의민족)2.1 Background and Market ShareEstablishment Time: Baemin was founded in 2010. It is one of the largest food delivery platforms in South Korea and is affiliated with Woowa Brothers, a South Korean Internet giant.

Market Share: Baemin accounts for more than 60% of the South Korean food delivery market share and is the most popular food delivery platform in South Korea.

Coverage: Baemin's services cover the entire territory of South Korea, especially in big cities like Seoul and Busan, where it has a very high market penetration rate.

2.2 Operation ModelPlatform Model: Baemin focuses on food delivery services, connecting consumers with food and beverage merchants. Consumers place orders through the Baemin application, and the platform is responsible for delivery.

Delivery Service: Baemin has a large network of riders and offers fast delivery speed, usually completing orders within 30 - 45 minutes.

Co - operating Merchants: Baemin collaborates with various food and beverage enterprises, including chain restaurants, small and medium - sized restaurants, and street snack shops.

2.3 Competitive AdvantagesPowerful Brand Influence: Baemin is one of the most well - known food delivery platforms in South Korea, with a very high user loyalty.

Localization Strategy: Baemin attracts local consumers by collaborating with local restaurants to launch special menus.

Diversified Promotional Activities: Baemin often launches discounts, coupons, and exclusive member activities to attract consumers to place orders.

2.4 Significance for Suppliers and TradersIncreasing Exposure: By collaborating with Baemin, food and beverage enterprises can increase brand exposure, especially among young consumers.

Flexible Delivery Services: Baemin's various delivery options can help food and beverage enterprises better meet consumer needs and improve customer satisfaction.

3. Yogiyo (요기요)3.1 Background and Market ShareEstablishment Time: Yogiyo was founded in 2012. It is the second - largest food delivery platform in South Korea and is now controlled by the German Delivery Hero Group.

Market Share: Yogiyo accounts for about 20% of the South Korean food delivery market share and is the main competitor of Baemin.

Coverage: Yogiyo's services cover the entire territory of South Korea, especially in small and medium - sized cities and suburbs, where it has a relatively strong market penetration rate.

3.2 Operation ModelPlatform Model: Yogiyo also adopts a platform model, connecting consumers with food and beverage merchants. Consumers place orders through the Yogiyo application or website, and the platform is responsible for delivery.

Delivery Service: Yogiyo has its own rider team and offers relatively fast delivery speed, usually completing orders within 30 - 60 minutes.

Co - operating Merchants: Yogiyo collaborates with various food and beverage enterprises, including local restaurants, international chain brands, and street snack shops.

3.3 Competitive AdvantagesFocus on the Food Delivery Field: Yogiyo focuses on food delivery services and has accumulated rich industry experience and technical advantages.

Flexible Delivery Options: Yogiyo provides a variety of delivery options, including instant delivery and pre - ordered delivery, to meet the needs of different consumers.

Price Competitiveness: Yogiyo often launches low - price promotional activities to attract price - sensitive consumers.

3.4 Significance for Suppliers and TradersExpanding Sales Channels: By collaborating with Yogiyo, suppliers can reach more consumers, especially in small and medium - sized cities and suburbs.

Enhancing Brand Awareness: Yogiyo's promotional activities can help suppliers enhance brand awareness and attract more consumers.

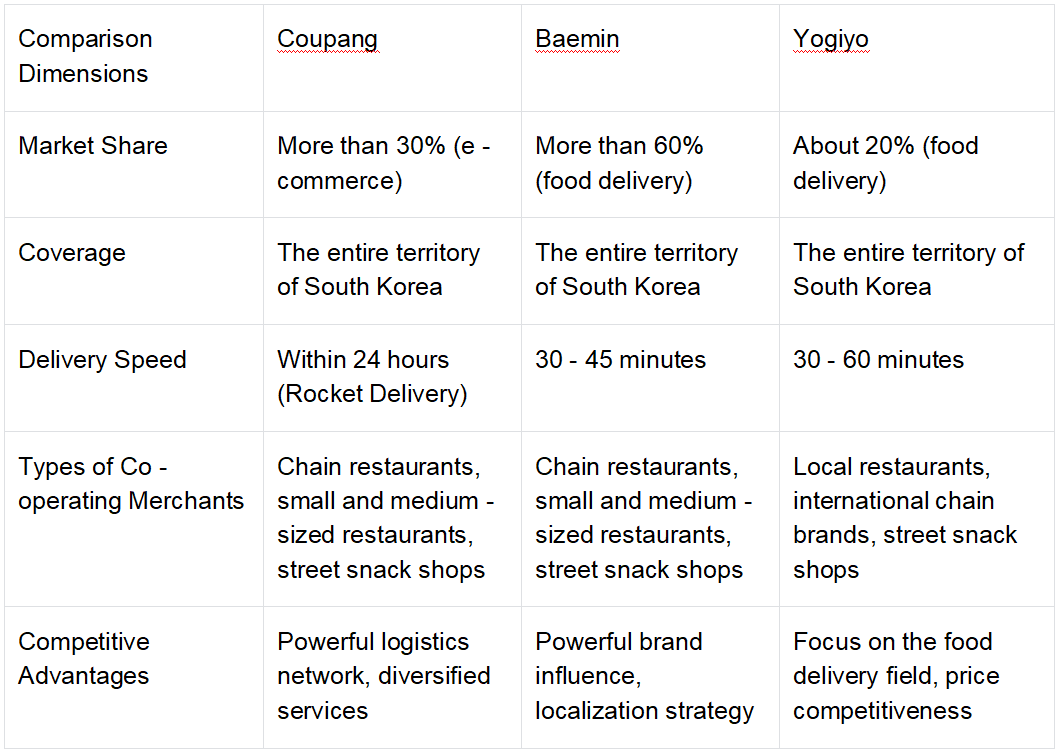

4. Comparison of Coupang, Baemin, and Yogiyo 5. Future Trends of the South Korean E - commerce and Food Delivery Markets5.1 The Integration of Healthy Eating and Food Delivery

5. Future Trends of the South Korean E - commerce and Food Delivery Markets5.1 The Integration of Healthy Eating and Food Delivery

With the increasing attention of consumers to healthy eating, food delivery platforms have begun to launch healthy meal options. Suppliers and traders can cooperate with food delivery platforms to provide healthy ingredients to meet consumer needs.

5.2 Sustainable PackagingThe enhanced environmental awareness has promoted food delivery platforms to adopt sustainable packaging. Suppliers and traders can provide environmentally friendly packaging materials to help food and beverage enterprises reduce plastic use.

5.3 Technological InnovationFood delivery platforms are introducing more technological innovations, such as drone delivery and intelligent recommendation systems. Suppliers and traders can cooperate with the platforms to utilize these technologies to improve service efficiency.

Conclusion

Coupang, Baemin, and Yogiyo are the three major e - commerce and food delivery platforms in South Korea, each occupying a large share of the e - commerce and food delivery markets. With their powerful logistics networks, localization strategies, and price competitiveness, they have become important partners of food and beverage enterprises. For food ingredient suppliers and traders, collaborating with these platforms can not only expand sales channels but also optimize products and services through data analysis.

With the rise of trends such as healthy eating, sustainable packaging, and technological innovation, the e - commerce and food delivery markets in South Korea will continue to grow. Suppliers and traders need to closely monitor market changes, seize opportunities, and enhance their competitiveness to gain a favorable position in the South Korean e - commerce and food delivery markets.

创新博览会LOGO-white.png)

Copyright © China Chamber of Commerce of Food, Native Produce and Animal Products Edible Fungi and Products Branch

京公网安备11010102004652号 京ICP备05021290号-29 | Technical Support: Starify Privacy Policy Sitemap Contact Us

创新博览会LOGO.png)

.webp)